Health costs have soared over the past 30 years. Public and private employers have paid the majority of costs. In 2018, 158 million people in the US received their health insurance through their employer. The decline in quality of care combined with healthcare inflation catalyzed employers to take a stand for their employees’ health and financial well-being, as well as their company’s prosperity.

Walmart responded to unnecessary care.

Since 2013, Walmart has ranked number one on the Fortune Global 500. Their business practices have not only been geared toward products and services, but also, fueled by their commitment to their employees. In this general session, the Walmart Senior Director for Health Benefits, Lisa Woods, and Vice President of Health Transformation, Marcus Osborne, shared Walmart’s approach to healthcare and how their employees reaped the benefits.

“There is 30% waste in the system,” said Woods, “and there may be misdiagnoses as high as 30%.” Expenses rose with overtreatment and misdiagnoses that lead to complications, so Walmart implemented a Centers of Excellence program involving hospitals and health centers that are the best at what they do, whether it is cancer treatment, spine surgery, diagnostics, cardiac care, etc. Centers of Excellence offered the complete continuum of care at a lower cost with higher quality outcomes than other providers.

Walmart partnered with Mayo Clinic and other designated facilities. They set out to ensure their associates receive quality care for their specific conditions and procedures. Walmart paid for their travel and treatment at designated Centers of Excellence across the country to remove barriers to top quality care. Of the associates who were told they needed spine surgery by their local physicians, over 50% were told by a Center of Excellence the spine surgery was unnecessary.

Through the fee-for-service model, physicians were incentivized to provide more services. Walmart learned that over 30% of prescribed care had been unnecessary, expensive, and dangerous. Centers of Excellence physicians served on a panel and used evidence-based models for diagnosing and treating patients with accuracy. Physician compensation was salary-based, not fee-for-service, which reduced unnecessary procedures due to misaligned incentives.

The Leapfrog Group exposed healthcare providers.

To their detriment, many patients have not known how to access data on the quality of healthcare providers. The Leapfrog Hospital Safety Grade 2019 report showed that the risk of patient avoidable deaths at “B”, “C”, “D”, and “F” hospitals, in comparison to “A” hospitals, ranged from 35% to a 92% greater risk of avoidable death. The report found “C” hospital patients had an 88% greater risk of avoidable death. Most U.S. consumers have not been shopping for healthcare like they have been shopping for other goods because they have not known where to find the information.

Since 2000, informed consumers have had access to the annual Leapfrog Hospital Safety Grade report by the Leapfrog Group, a nonprofit funded by employers who sought to create transparency in healthcare. According to Leapfrog, the Hospital Safety Grade was calculated based on hospital records of “errors, accidents, injuries and infections.”

Health insurers have been profiting from big medical bills.

Source: Debt.org

Quality has not been the only blind spot in healthcare. Unlike other markets where prices have been presented prior to purchase, the healthcare market has been ambiguous about their prices until after services have been provided. For many insureds, the healthcare bills have been unfathomable and a complete surprise.

In addition, employers have been expected to trust the insurance company they hired to negotiate on their behalf without being privy to the breakdown of expenses. Billed charges are inflated to boost the insurance company discount rates.

Insurance companies have been under pressure from shareholders to add members and increase profits, even if it means contracting with higher cost hospitals and accepting higher charges. Their business plans have been relying on keeping hospitals happy at the expense of employers. In 2016, the average PPO network prices were 260% relative to Medicare (Chase 2017).

Health insurers have been profiting from big medical bills. There have been no incentives for large plans such as Aetna, Cigna, UHC, and Anthem to manage the cost of care. These companies have been making more money with higher claims.

The state of Montana saved $1 million per month.

In 2014, with over 30,000 employees, the state of Montana hired a new health plan administrator, Marilyn Bartlett, who had the experience and wisdom to push back against providers to combat healthcare spend and inflation for the State of Montana.

Overcharging had become standard practice. According to The CEOs Guide to Restoring the American Dream, the average commercial payer pricing had been as high as 1,000% of Medicare. Insurers and hospitals were keeping up with the practices of their competitors. Competitive prices in any other market may have referred to offering consumers lower prices and bargains, but the healthcare industry had its own ecosystem with the consumer at the bottom of the food chain.

Bartlett had a plan to set her own prices relative to Medicare, since Medicare published its rates. Bartlett provided her own relative-based pricing to hospitals, offering them more than twice the Medicare rates. In some cases, hospitals refused to accept the agreement.

The lower cost hospitals signed the contract because the pricing benefitted them. Once the lower cost hospitals signed, the higher cost hospitals budged in fear they would lose business to neighboring hospitals. After this, Bartlett had six holdouts. In areas populated by a considerable number of Montana state employees, it was crucial to get all the hospitals on board.

Hospital CEOs and lobbyists petitioned the governor’s office and set up meetings. Unbeknownst to them, Bartlett had been invited. She intercepted their pitches.

Less than a month out from the start of the new pricing, five out of the six hospitals buckled and signed the contract. After the contract went live, union workers campaigned against the sixth hospital until they signed the contract. Bartlett succeeded.

The hospitals were tamed, but pharmacy benefit managers were running wild.

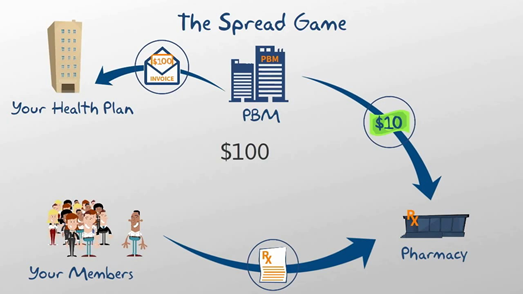

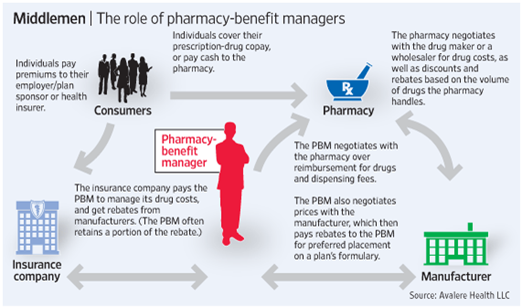

Montana’s previous pharmacy benefit manager (PBM) failed to provide a full accounting of the plan’s prescription drug costs when Bartlett demanded transparency. PBMs had been known to tack on the “spread.”

Source: Daily Market Headlines

In negotiations with the pharmacies and drug manufacturers, PBM’s have settled on discounted rates and rebates for prescription drugs. However, the rates presented to the consumer and employer have been higher, excessive, and unreasonable. Likewise, the full rebates have not been passed down to the employer who paid for the plan. PBM’s have been pocketing this extra amount called the spread, which has been permitted by the fine print in pharmacy plan contracts.

Source: The Wall Street Journal

There was one PBM, Bartlett found, that had exchanged the common model for a transparent model. Navitus Health Solutions did not take a spread and all rebates were passed to the employer in full. The year after Navitus was implemented, the state of Montana saved an average of almost $16 per script. The revenue in rebates doubled to $7 million, and without the spread, the health plan saved $2 million on prescription drugs.

Montana’s health plan renovation was complete. Over the next two years, Montana saved $1 million per month in the first two years and increased savings to $15 million per year in the following years. The savings did not require cutting benefits or raising costs for the employees.

Health Rosetta: a case study.

Health Rosetta, comprised of various consultants and employer groups, has represented 3.7 million lives in the US with their mission to push back “against 50+ years of hyper-inflating costs.” Health Rosetta has focused on value-based care with various approaches to primary care, transparent pharmacy benefits without hidden fees, and removing incentive conflicts that increase costs.

A case study on regional chain Rosen Hotels and Resorts (RH&R) from Orlando, FL traced the results of the application of Health Rosetta’s principles. The company implemented the HR concepts in 1971 when it had 500 employees. As of 2019, RH&R had 5,700 employees.

Rosen Hotels and Resorts saved $240 million over 24 years.

Quality Care

- Unlimited, free, onsite, round-the-clock primary care

- Free preventive care and transportation to appointments

- Onsite fitness, flu shots, vaccines, family planning, and nutritional services

- Onsite healthy meals priced more affordable than unhealthy meals

Cost management

- Relative-based pricing based on a percentage of Medicare

- $15 copay for office visits

- $0 for 90% of prescriptions

Harris Rosen, founder of RH&H, did not opt for the high deductibles, high copays, and co-insurance in order to cut costs. They applied the US Preventive Services Task Force guidelines, provided physicals, dietitian visits, and ensured healthcare was accessible to their employees. Thanks to their focus on preventive health practices, they saw a decrease in new chronic illnesses among their employees, therefore, cutting costs by increasing health, instead of increasing deductibles.

Community Impact

The most compelling impact of the RH&R’s healthcare cost savings was their involvement in the community. Not only did Rosen utilize their funds to offer employees and children free state college education, he also paid for preschool in Tangelo Park, a neighborhood in Orlando that had been underserved and tarnished by crime. Rosen furthered his philanthropic ventures by funding programs for the development of those kids and paying for their college tuition and books. To date, Rosen has paid for 450 college educations and crime rate in the community dropped by 63%.

The strategies that have worked

Centers of Excellence

Employers dedicated to helping employees when they’ve had complex healthcare issues by paying for their treatment and travel to Centers of Excellence have avoided the burden of misdiagnoses, unnecessary care, and ineffective treatment plans. Most programs have zero employee cost, so barriers to high quality care are removed for the employee. These Centers of Excellence have been crucial in cases of cancer and other serious health conditions, providing more effective and safer treatment plans as well as more accurate diagnoses. Orthopedic programs with step programs in lieu of surgery have also countered health costs and avoided procedures with long recoveries and costs. Best of all, employees appreciate access to Centers of Excellence as a valuable benefit. They are able to access the best facilities in the country at little or no cost.

Employee Concierge

Every American deserves to be educated about physician and hospital quality data. Within PPO networks is a tremendous variance in quality and cost. Without a concierge to guide employees to high value providers, employees are rolling the dice – risking their health and possibly paying more. When employees engage with a concierge vendor, the employee receives cost and quality data for the physicians and facilities. Naturally, patients will visit high value providers when armed with the information. This results in better outcomes, less complications and readmissions, and lower short and long term costs for the employer.

Direct contracts and reference-based pricing.

By changing the way they purchase healthcare, employers have been able to reduce costs. Using the reference-based pricing method relative to Medicare has been proven to be effective when contesting astronomical healthcare charges. Furthermore, the healthcare system has had built-in incentives for insurance companies to favor larger bills, so removing these incentives has benefitted employers.

Transparent PBMs

PBIRx, an independent pharmacy consultant, implemented auditing of contracts and claims, plan design recommendations, and negotiations with PBMs which resulted in a 55% savings in a national employer’s prescription drug expenses. Negotiations with PBMs included rebate negotiations. When employers have been aware of the spread and hidden fees, they were able to negotiate for transparent pharmacy benefits with no spread pricing, defined per employee or per script costs, and no hidden fees.

Totem Health

Totem has been committed to working with employers to reduce cost and improve employee retention. Totem’s VP of Business Development, Annette Griffin, has been certified as a Health Rosetta advisor. As a result, Totem Health’s healthcare philosophy and approach has been aligned with the components of Health Rosetta because these initiatives have been shown to improve the quality of healthcare delivered to employees and their families.

References

Allen, Marshall. “In Montana, a Tough Negotiator Proved Employers Don’t Have to Pay So Much for Health Care.” ProPublica, March 9, 2019. https://www.propublica.org/article/in-montana-a-tough-negotiator-proved-employers-do-not-have-to-pay-so-much-for-health-care.

Chase, Dave. The CEOs Guide to Restoring the American Dream: How to Deliver World Class Health Care to Your Employees at Half the Cost. Seattle, WA: Health Rosetta Media, 2017.

Collins, Sara R. “Health Insurance Coverage Eight Years After the ACA: Commonwealth Fund.” – 2018 Biennial | Commonwealth Fund, February 7, 2019. https://www.commonwealthfund.org/publications/issue-briefs/2019/feb/health-insurance-coverage-eight-years-after-aca.

HLTH. “General Session: Lisa Woods and Marcus Osborne, Walmart.” YouTube, June 4, 2018. https://www.youtube.com/watch?v=n87g_mb_kuk.

“New Report Finds Risk of Death Nearly Doubles for Patients Using Hospitals Graded As ‘D’ or ‘F.’” Leapfrog, May 15, 2019. https://www.leapfroggroup.org/news-events/new-report-finds-risk-death-nearly-doubles-patients-using-hospitals-graded-“d”-or-“f”.

“PBIRx® Is How You Can Get More Control Over Your Healthcare Costs.” PBIRx. Accessed January 10, 2020. https://pbirx.com/index.php.

“Rosen Hotels Case Study.” Health Rosetta, n.d. https://healthrosetta.org/rosen-hotels-case-study/.

“Walmart.” Fortune, November 20, 2019. https://fortune.com/fortune500/2019/walmart/.