Despite significant pressure from the federal government, PBMs are winning, while employers and patients are struggling to keep up with the increasing costs. In every other industry, innovation has led to the middle-man getting squeezed, yet in Pharmaceuticals, the PBM continues to grow more profitable and powerful each year. The mechanisms for this are still largely shrouded in legal secrecy thanks to their top notch lawyers and lobbyists. Here are 6 ways that the Big 3 PBMs are taking advantage of employers & patients:

- Rebate driven formularies: Rather than your plan covering the best value drugs (efficacy + cost), it’s covering those that provide the highest rebates. For example, Duexis is still on most formularies. Its Advil + Pepcid in one pill and costs $827 per month. PBMs offer some formulary customization, but their top revenue drivers are off limits.

- Keeping the rebates: A portion of every manufacturer rebate is retained by the PBM, and that percentage is confidential. Plus, they keep 100% of OTC rebates and most POS rebates.

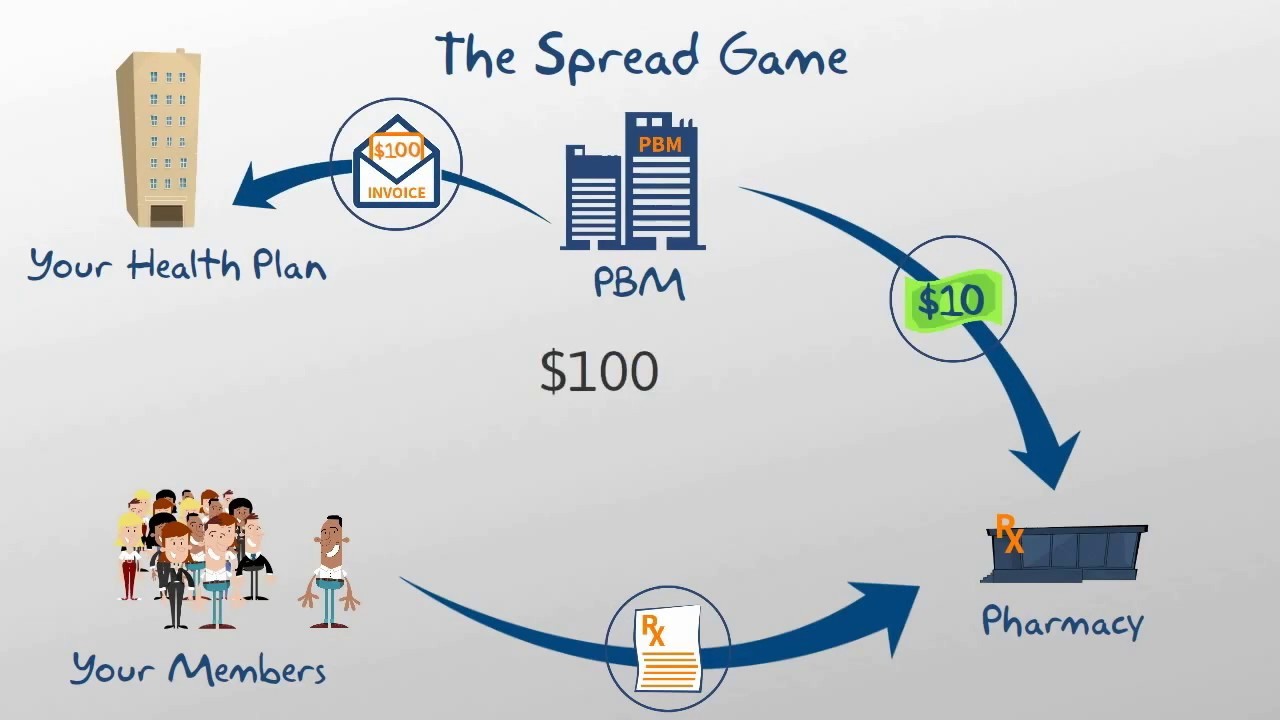

- Spread pricing: The price that the PBM pays the retail pharmacy is less than what they bill you for. They keep an average margin of 20%.

- Mail order abuse: The spread is even higher on mail order, and an auto-fill feature means that employees are being sent drugs they’re no longer taking. Early fill means that employees are accumulating 40 extra pills per year.

- Specialty drugs: Big PBMs approve 97% of specialty drugs, which are responsible for a big chunk of medical cost inflation. Third party review of clinical appropriateness reveals that only 67% of these drugs should be approved.

- Reclassifying: Unless explicitly addressed in your contract, your PBM will reclassify generic drugs as Brand. They pay the pharmacy the generic fee and then charge you the Brand fee. Now, their spread is even higher.

So what can you do about all of this? There are a handful of Transparent PBMs that have emerged in recent years. By making this switch, employers are saving 15 – 25% on their pharmacy spend, which can add up to 5 – 10% of total medical spend. Below are some key features of a Transparent PBM:

- Rebates: 100% of rebates go the employer.

- Contract: Simple and transparent contract so that you don’t need a team of lawyers to make sure you’re not getting ripped off.

- Formulary: The formulary is fully customizable and is initially based on their best-value recommendations.

- Revenue: Their only revenue stream is a monthly admin or per claim fee.

- Spread: There’s no spread. You are charged the same price that they pay the pharmacy.

- Audit Rights: You have a right to audit them at any time with minimal notice.

- Specialty Drugs: You may bolt on a 3rd party review vendor for specialty drug approval.

-Geoff Rowson