Totem’s not your average employee benefits broker; we’re proud of that. As an HR professional, getting stuck with a lousy employee benefits broker not only means a low-quality employee benefits plan, but more work added to your plate.

Choosing an employee benefits consultant is no small task. And, it should be taken seriously. Studies have shown that these are the top 5 things employers look for when selecting a broker:

- Prompt, effective service

- A trusted advisor

- Compliance resources

- Regular communication

- Competitive pricing

An impactful benefits consultant knows what clients (and their teams) need – from top-notch benefit offerings and cost-containment solutions to employee-centric tactics like streamlined benefits administration, assistance with enrollment and year-round employee communication and support.

If your employee benefits broker isn’t checking those boxes, it’s time to reconsider.

Here are 7 Ways to Avoid a Bad Employee Benefits Broker

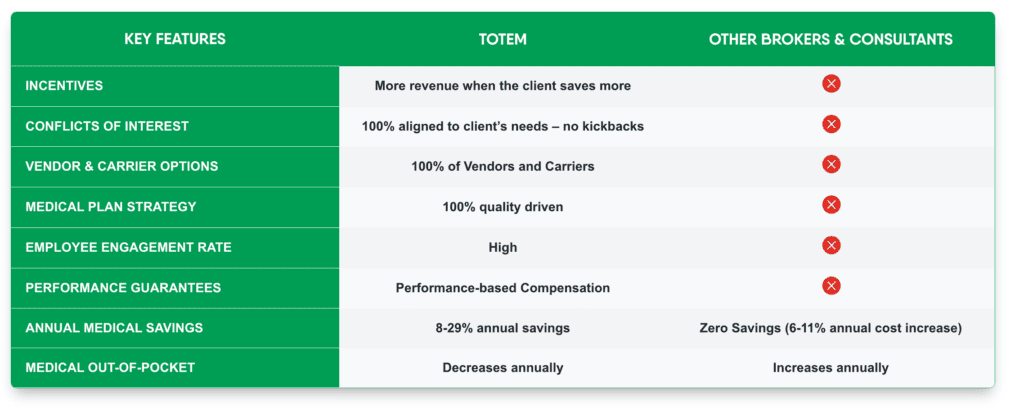

1. Make sure they are not driven by bad incentives.

Most benefits brokers are fueled by incentives – the more money you spend, the more money they make. Not with Totem. Our revenue increases when our clients save more.

2. Employee benefits brokers should avoid conflicts of interest.

Similar to our point above, your benefits broker should be 100% aligned with your needs – no kickbacks. This ensures you’re both on the same page when it comes to your benefits plan and your budget.

3. Ask about their client’s employee engagement rates.

Benefits brokers can go on and on about their solutions and how they will better your organization. But do they have the data to back it up? Your employee benefits plan is no good if your employees aren’t utilizing it. Employee benefits brokers should have solid proof that their employee engagement strategy works – and well.

4. Choose a broker that offers performance guarantees.

What better way to know your benefits broker is on your side than by including performance guarantees? Performance-based compensation is a sure way to know that when your organization does well, so does your broker.

5. Review annual medical savings.

Cost containment is a serious point of focus right now for all businesses. With the nature of medical benefits, it can be quite an expense for your company. Employee benefits brokers should be in the business of achieving annual medical savings for their clients. At Totem, we help clients save 8% – 29% annually.

6. Request proof that they can decrease medical out-of-pocket.

For most employers, medical out-of-pocket costs increase annually. It doesn’t have to be this way. When you partner with the right benefits broker, you can actually decrease those costs annually.

7. Request a quality-driven medical plan strategy.

If your benefits broker’s proposed medical plan strategy isn’t driven by quality providers, it’s time to find a new partner. By directing your employees to the best care available in their area, you’re not only taking better care of your team and their families, but reducing costs for your business and employees.

Don’t entrust your employee benefits plan to a broker who missed the mark. By doing your due diligence and asking the right questions, you’ll find an employee benefits broker who partners with you to achieve common business goals and take care of your people.

If you’re interested in learning more about Totem and our unique approach to employee benefits, connect with our team today for a complimentary consultation.