Open enrollment arrived like an ambush and was gone faster than a cappuccino order. Preparing for the time sensitive event carried significant importance that ultimately impacted the well-being and quality of life for the district employees and their families.

A Public School District Outsourced Benefits Administration And This Happened…

Mid-year 2019, Totem was awarded another public sector account: a public school district in Georgia. Within a few months, rates were negotiated with insurance companies to save the school district and employees money, voluntary benefit offerings were enhanced, and the new service center and mobile benefits website went live.

As a public school district, this employer was responsible for a considerable employee and student population. Totem ideated, refined, experimented, and mapped the plan to best serve the employer and employees.

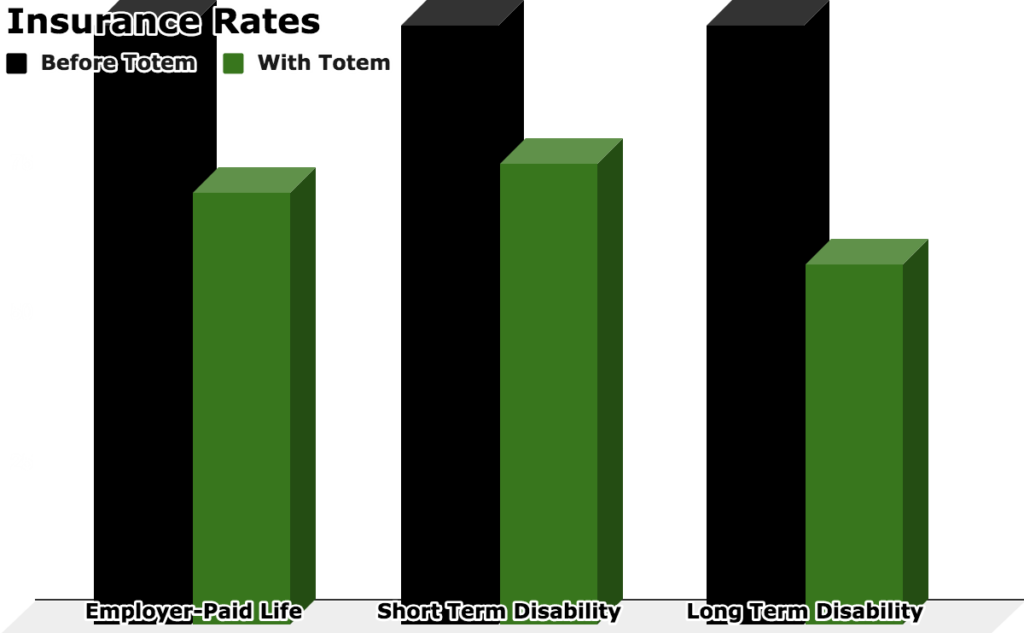

The first instinct was to improve plan financials. Employer paid life insurance premiums were reduced by 28%, and the employee paid life insurance rates were lowered up to 40%. Voluntary life insurance coverage increased by 24%, while total premiums remained constant. This showcased the mutually beneficial advantages of the negotiations; not only did the employer save money, the employees now had more life insurance protection for themselves and their families for the same or lower payroll deductions.

Rate reductions for short term disability and long term disability were also achieved at 13% and 60% respectively. In addition, health questions, or Evidence of Insurability, previously required, were no longer required for employees to enroll in these valuable benefits.

Individual plans were retired in favor of more affordable group coverage. Plan years were amended for ease of transition, so all benefits would have the same enrollment period and effective date.

New products were introduced during Open Enrollment

Critical illness insurance, accident insurance, and hospital indemnity insurance were newly offered. The plans included portability, and employees could easily enroll with no health questions. These otherwise exclusive benefits became accessible and portable in the case of severance.

For the first time, the public school district offered its employees an identity theft plan to protect their growing digital footprints. A new and affordable universal life policy with long term care was also brought in as a permanent life insurance product.

Benefits Administration Automated + Manual Support

After extensive development and testing on the test site, the mobile benefits website went live in October. Even those that did not complete their enrollment online enjoyed the convenience of accessing benefits resources online.

The website analytics indicated 733 users, about 975 sessions, and eleven percent of sessions were mobile accessed.

From the 99.9% of eligible employees who completed an active enrollment, 16% completed a telephonic enrollment via the Totem Benefits Service Center. The new service center handled a total of about 600 inbound and outbound calls.

About 15% of the employees (approximately 250) elected new benefits, and over 500 employees received assistance from the Benefits Service Center. Totem offered more affordable benefits and provided new resources to both the employer and the employees.

With year-round employee support for benefits questions and claims inquiries, the school district’s HR staff was alleviated from the open enrollment influx of employee requests.

The public school district trusted the employee and human resources service model that is unique to Totem. This included HR and benefits messaging, not only with inbound and outbound phone calls, but also with mobile text messaging, email, and a benefits website, which included self-service enrollment. Totem provided comprehensive benefits administration for HR with automation and manual support. This, combined with Totem’s plan recommendations and consulting, resulted in a “win-win” for the district’s employees and benefits-team.