One Big Beautiful Bill Act: Key Impacts for Employers and HR Leaders

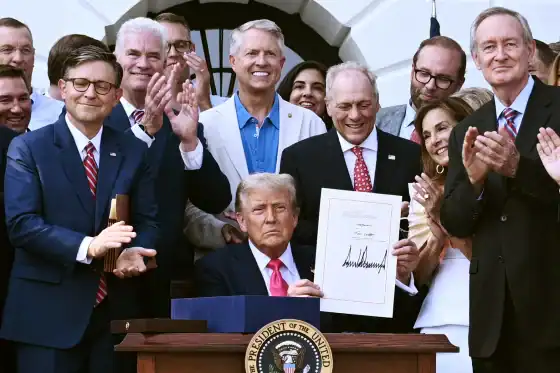

On July 4th, 2025, H.R. 1—the sweeping One Big Beautiful Bill Act—was signed into law following razor‑thin votes in both the House and Senate. This comprehensive reconciliation package delivers major tax reforms, social program cuts, new benefit credits, and expanded healthcare parameters—many of which carry direct implications for employers and HR strategy. Here’s what benefits teams and executives need to focus on.

1. Tax & Compensation Structures

Tip and Overtime Tax Deductions

The bill creates new federal income tax deductions for wages from tips and overtime, capped at $25,000 per year per employee for individuals earning under $150,000. This is scheduled to sunset in 2028. For employers, this could influence payroll design and incentive structures, especially in tip-reliant roles such as hospitality, food service, and gig work. HR leaders should revisit pay practices and employee advisory materials.

Increased SALT Deduction Cap

The federal state-and-local tax (SALT) deduction cap has been raised—up to $30,000 or even $40,000 for households earning under $500,000, depending on final regulatory guidance. While SALT is traditionally outside employer control, benefits professionals may want to update financial planning education to reflect enhanced employee tax relief.

2. New Savings Vehicles: “Trump Accounts”

The Act establishes tax-advantaged “Trump Accounts” for babies born between 2025 and 2028. Each newborn receives a $1,000 government deposit, and parents can contribute up to $5,000 per year, with tax-deferred growth if used for education, training, or first-home down payments.

Employer implications:

- These accounts function similarly to IRAs but with distinct purposes. HR may need to incorporate education about this new vehicle into total-rewards communications.

- Consider integration with existing financial wellness offerings, especially for new or expecting parents.

- Monitor IRS guidance for potential payroll deduction facilitation or voluntary participation features.

3. Employer-Provided Child Care Credit

The bill increases the employer-provided child care credit, effective for tax years starting after December 31st, 2025.

What HR should consider:

- Reevaluate the structure and promotion of employer-sponsored child care assistance or dependent care FSAs.

- Update budgeting and policy design to maximize the new credit—particularly appealing for mid-sized and larger employers.

- Highlight this benefit in total-rewards messaging: stronger child care support at lower net cost to both the company and employees.

4. Health Plan Flexibility & HSA/HDP Expansion

The Act expands the permissible use of pre-tax health dollars retroactive to plan years starting after December 31st, 2024. Starting January 1st, 2026, employees may use pre-tax funds for:

- Direct primary care arrangements (within IRS limits)

- Telehealth and remote care services

Why this matters:

- HDHPs with HSAs will need updating to allow for the newly eligible expenses.

- Employers may want to revisit plan vendor capabilities—especially around telehealth and direct primary care.

- Benefits communication and enrollment materials should be refreshed to reflect these changes.

5. Medicaid, SNAP & Workforce Impacts

Although not employer mandates, the bill’s cuts to Medicaid and SNAP—including stricter work requirements (e.g. 80 hours/month) and reduced eligibility—will likely impact the workforce indirectly.

What HR should anticipate:

- Employees currently relying on public health coverage or food assistance may experience loss of benefits, creating potential stress, turnover, or increased requests for employer-sponsored support.

- Employers may see heightened demand for benefits such as medical coverage, EAPs, child care, or transportation subsidies.

- Consider proactive workforce planning with HR, benefits, finance, and vendor partners to assess support strategies.

6. Payroll, Compliance & Reporting Updates

While the bill does not alter retirement plan rules (401(k), IRA, 403(b)), there are compliance and employee education implications:

- New tax deductions and credits will affect W-2 reporting and payroll withholding strategies. Coordinate updates with payroll and finance.

- Financial wellness programs may need new content focused on Trump Accounts, child care credits, SALT cap increases, and deductions for tip/overtime income.

- Open enrollment materials, onboarding guides, and benefit portals should reflect these new provisions to avoid employee confusion.

While H.R. 1 does not directly impact employer-sponsored retirement plans, it introduces significant changes across tax policy, benefit incentives, healthcare accounts, and public assistance programs. These changes are not just regulatory—they reshape the employer-employee value equation. HR and C-suite leaders who move early to educate, realign, and enhance offerings will be better positioned to attract and retain talent while managing long-term risk and cost.